Does Credit Score Affect My Insurance Premiums?

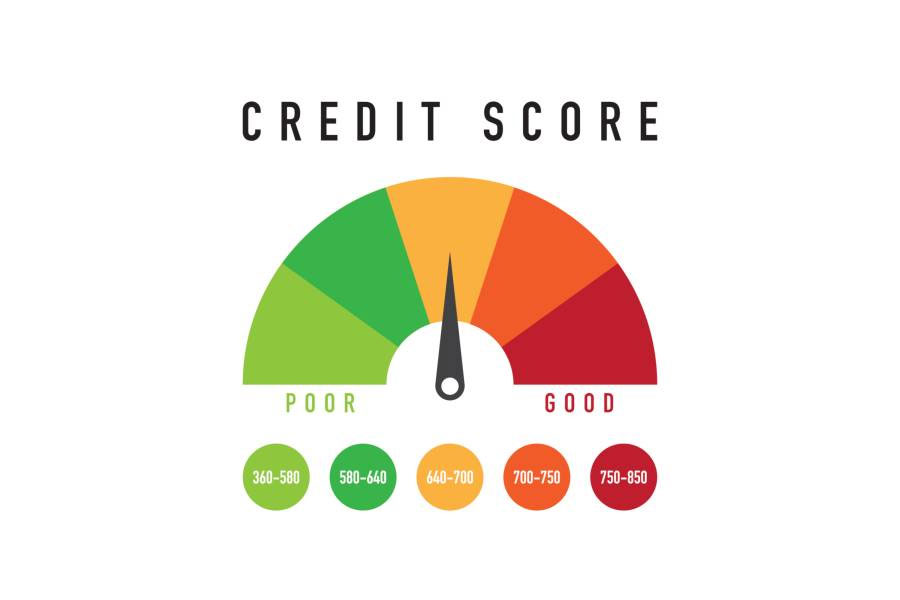

Credit score has a huge influence on one’s ability to secure financial products such as mortgages. The lower your credit score, the higher the rates you will pay. In some areas, it will also influence your ability to secure employment and a place to rent. But can your credit score also influence your insurance premiums, especially for auto insurance? The truth is that it does.

Considering that auto insurance is compulsory for all drivers, people are always looking at how to get better premium rates so that they can be able to save a few coins. Therefore, the biggest concern for such people is whether their credit score will a hindrance to their quest for competitive rates. Will they end up paying more for auto insurance just because they defaulted on some loan?

Risk Assessment

Just like the other players in the financial industry, insurers are interested in knowing how much gamble they are taking with you. Though auto insurance premiums are mainly affected by driving experience, claims history, and intended use of the vehicle among other things, your credit score also plays a minor factor. A lower credit score is taken as an indication of being irresponsible in other aspects of life and, therefore, a liability to the insurer.

People with a poor credit score are likely to be charged more in insurance premiums than those with excellent scores. The logic is that you are likely to lodge more auto insurance claims. Insurance companies argue that there is a correlation between one’s credit scores and their chances of getting involved in an accident. The insurers aim to minimize the number of claims filed in order to secure their financial interests.

Most insurers base their premiums on credit-based insurance scores which are formulated from your financial credit score. Your credit history is taken into account, even though not everything in your credit report is included. The practice is however not allowed in some areas.

It is hard to determine exactly how much your credit rating will influence your auto insurance premium as insurers are unwilling to divulge how they determine one’s insurability and the amount of premium to be charged. Available data, however, indicate that drivers whose vehicles are used as security to get finances are usually charged higher premiums. The more your credit score decreases, the higher your premiums go.

Way forward

Your premiums may vary across different auto insurance providers. For example, if you have a poor credit score yet has no claims history, different insurance providers will give you different ranges of prices. It all depends on their pricing philosophy and premium calculation algorithm. If you have a poor credit score, your sole focus should be on improving your credit rating rather than the impact it has on your auto insurance premium. It is important to managing your personal finances beyond insurance.

In as much as your credit score influences your insurance premium, your insurance doesn’t have any effect on your credit score. Delayed or unpaid premiums can only result in policy cancellation and not a bad report to the credit bureaus.